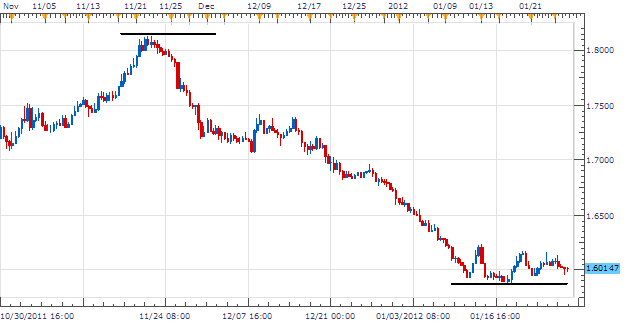

The EUR/NZD continues to be one of the strongest trending currency pairs in the market. From its November 2011 high at 1.8113, the pair has moved 2241 pips lower. The pair has recently found a bottom at the 1.5872 low, formed on January 18th. As price begins to ease lower, traders often question when to enter into an established trend .

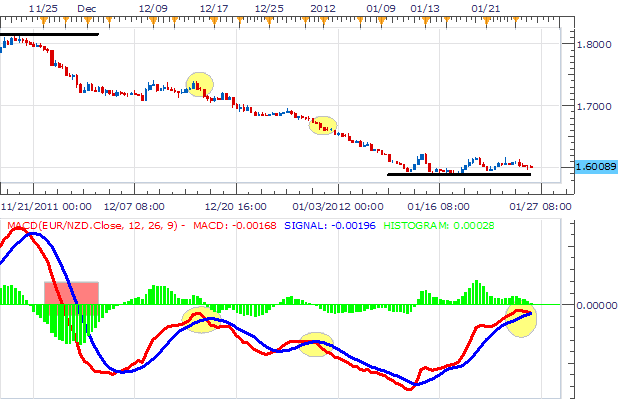

MACD can be an excellent tool for trading trending markets. The indicator itself is created by comparing a 12 and 26 period EMA. As the moving averages converge and diverge it creates buying and selling signals for momentum traders. Knowing how to utilize an indicator such as MACD enables a trader in timing an entry with the trend.

Adding MACD to our 8hr chart allows us to find momentum and areas to enter the EUR/CAD . First, we can use the zero line to assist us in establishing our trend. Below, highlighted in red, we can see MACD crossing our zero line on November 28th. Currently, MACD continues trading under 0.000 confirming our bearish bias.

Once direction is established, we can then begin taking trading opportunities using our oscillator. On our chart, we are looking at entrys when the MACD line crosses below our blue signal line. Previous opportunities, occurring on December 16th and 29th are highlighted in yellow. Traders utilizing this execution mechanism are now awaiting the next crossover in development. Do you have questions regarding MACD ? You can always join us on the forum linked here.

My preference is to sell the EUR / NZD on a MACD / Signal line crossover near 1.6000. Stops should be placed over 1.6175. Our limits should for a profit of 350 pips creating a clear 1:2 Risk/Reward ratio.

Alternative scenarios include price breaking resistance.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.