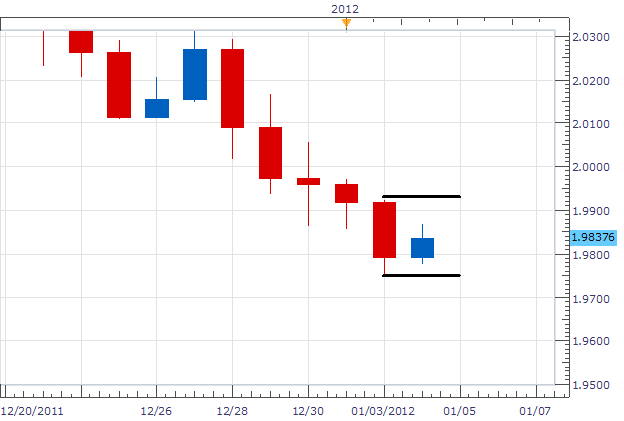

The GBP/NZD has continued to sell off in the first week of 2012 trading, as risk on trading has prevailed. Ultimately, the pair has declined 1189 pips from the November 2011 high printed at 2.1044 to its current January 2012 low at 1.9753. A developing inside bar, on the daily chart, will allow us to enter in on the next breakout for the pair.

Zooming in on Tuesdays and Wednesdays price action (1D Chart) we can see the development of an inside bar. An inside bar occurs when today’s price action does not exceed the previous day’s high or low. Price action from yesterday printed a daily high of 1.9924 and a low of 1.9753.

Today’s action has so far yielded a daily high at 1.9869 and a low of 1.9776, both well inside of yesterdays levels.Traders can use entry orders to trade a break of either the January 3rd high or low for entry. Expectations are that price will break and continue forming either a new high or low past this point. As described in our December 9th, Chart Of The Day , ATR can be used for setting profit targets. Current ATR for the GBP / NZD resides at 195 pips. 20% of this value, or 40 pips, will be our suggested limit.

My preference is to place entries on the GBP/NZD near the January 3rd high/low. Both stop/limits will look for 40 pips for a clear 1:1 Risk/ Reward ratio.

Alternative scenarios include continuing to trade “inside”, prior to a breakout.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.