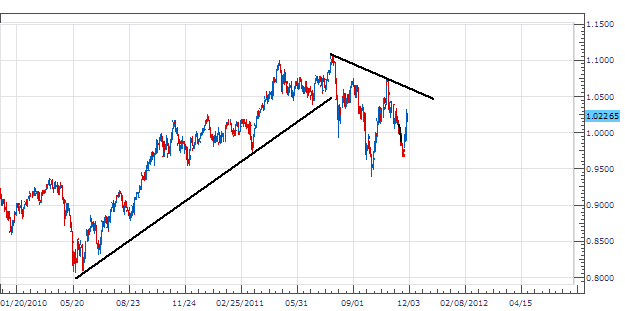

The AUD/USD for two years dominated as one of the FX markets strongest trends. This strong upward momentum culminated in a trend high printed on July 27th at 1.1079. Over the last four months, price has failed to yield a higher high. A quarterly low printed on October 4th at .9386, but no continued downside action has been seen since this point.

The AUD / USD continues to be the predominant “ risk on / off ” currency of choice. Fundamentally, the Aussie currency will advance on a better than expected global economic outlook. Tomorrows NFP , Non Farm Payroll, economic announcement will give us insight into the current state of the US economy. A positive or negative number could reflect a break to higher highs on our currency or a resumption of our short term downtrend.

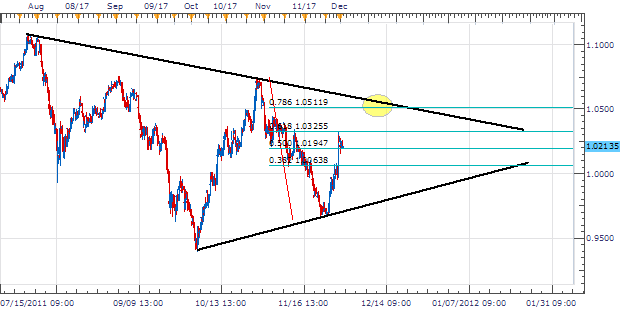

Taking Price in to a 4Hour chart we can see the AUD/USD consolidate in a traditional triangle pattern. Resistance is formed by joining the standing highs from July 28th and October 28th. Support is created by joining the October 4th and November 23rd lows. Traders looking for continued consolidation, or maintaining a bearish bias may look to sell against resistance. One plan of action is to place entry orders where our trend line and Fibonacci retracement levels meet.

My preference is to place entry orders to sell the AUD/USD at resistance near 1.0510. Stops should be above our trend line at 1.0610. Limits should look for a minimum of 200 pip minimum target for a clear 1:2 Risk/ Reward scenario. Secondary targets can include the triangle low near .9860

Alternative scenarios include price breaking out above current resistance levels.

Additional Resources

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.