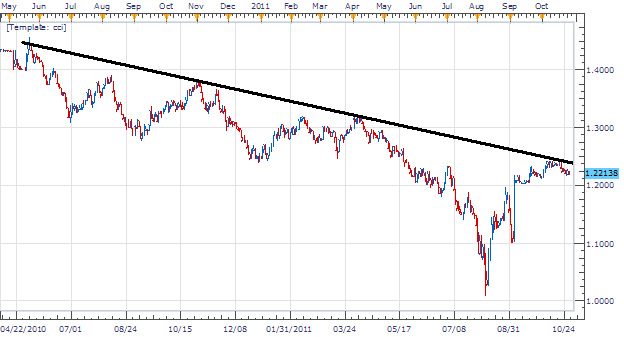

The EUR/CHF currency has been in a steady decline from its November 2007 high at 1.6827. Since this point price has trended 6760 pips lower to our current low formed on September at 1.0067. The pair is currently in a retracement and has made strides to test our downward sloping trend line pictured below. As the pair moves to long term resistance at 1.2450, trend traders will begin to look for the next leg down for lower lows.

Fundamentally, the CHF remains one of the world’s safe haven currencies of choice. As economic uncertainty has developed around the globe, the Swiss Franc has steadily continued to appreciate. However, in recent months the SNB (Swiss National Bank) has taken steps to stem the strength of their currency. As the tug of war between safe haven asset and central bank intervention occurs, we will on the economic calendar for further fundamental insight.

Taking Price in to a 4Hour chart, we can see the EUR /CHF begin to consolidate begin making lower lows starting from the October 19th high at 1.2466. Price has recently consolidated at 1.2180 near the support of our 200 MVA ( Simple Moving Average ). Breakout traders may look for lower lows to be created once current support is broken to enter in with the broader trend.

My preference is to sell the EUR/CHF on the creation of new lows outside of the 200 MVA. Orders should be placed under 1.2120 or better. Stops should be placed 150 pips away over 1.2270. Limits should look to first target 1.1820 for a clear 1:2 Risk/ Reward Profile.

Alternative scenarios include price breaking through resistance and moving on to new highs.

Additional Resources

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].