Previous: The European Debt Crisis

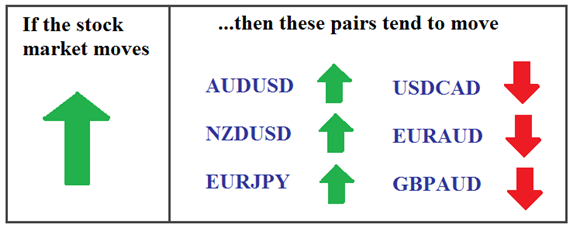

Stock market movements are watched by casual investors to active traders. Many times, the movements of the stock markets can give clues about potential movements in currency trading. Below is a table of general tendencies that a trader familiar with stock trading can use to guide them in forex trades.

If the stock market is said to be in a “risk on” mode with prices on the rise, then you tend to see these currencies below trade in noted general directions.

For example, if the stock market moves higher, you tend to see the AUDUSD move higher as investors seek risky assets. Risky assets include the stock market and higher yielding currencies which currently are the AUD and NZD .

At the same time, as investors seek out ‘risky’ assets, currency pairs like the EURAUD and GBPAUD tend to fall as traders look to earn the large daily dividend those pairs offer. This is known as a Carry Trade Strategy.

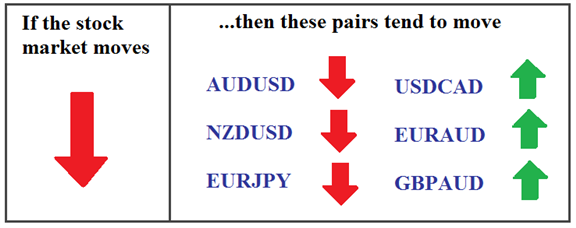

On the other hand, if traders are in a ‘risk off’ mode and are averse to risk, the opposite of these relationships tend to occur.

For example, if the stock market is in a downtrend, then a currency pair such as the USDCAD tends to move higher as traders buy the USD for its safe haven status.

Regardless of the movement of the stock market, there generally exists a currency which you can buy. Now, the key is identifying a high probability area to time an entry in the trade. Use levels of support and resistance to identify these key areas with the help of oscillators to indicate momentum.

*Keep in mind correlations move into and out of favor with one another. Therefore, a price of one instrument is not always going to move tick for tick with the other related instrument.

Next: "Risk On" versus "Risk Off"

---Written by Jeremy Wagner, Lead Trading Instructor

To contact Jeremy, email [email protected] . Follow me on Twitter at @JWagnerFXTrader.