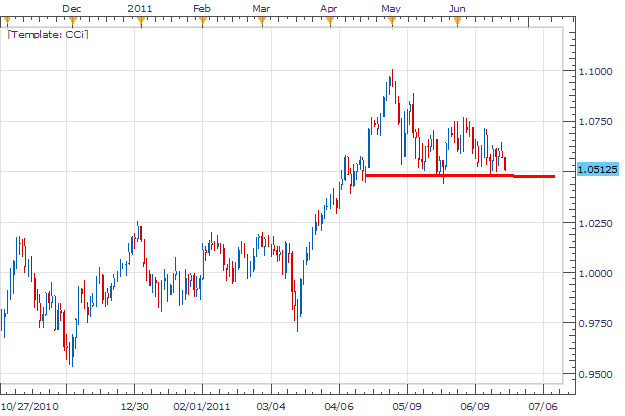

The AUD/USD has been steadily declining over the past two months since creating a new high on May 2nd at 1.1011. Currently the pair is testing support near the 1.0500 figure. This level has been tested repetitively however has remained strong and failed to hold a conclusive break at this juncture. Traders will be looking for either a bounce to new highs at this level or a break of support creating fresh lows.

Fundamentally both pairs are mixed. The US FOMC meeting revealed that Ben Bernanke recognized a softening in the economy marked by rising unemployment and inflation . There was no mention of a new quantitative easing in his speech. With no fresh government support on the horizon investors began to take their money out of riskier markets and assets causing most currencies to decline relative to the dollar.

Price Action

Moving in to a H4 chart, we can see a Descending Triangle forming on the AUD / USD currency pair. Normally descending triangles are known as continuation patterns and normally form during downtrends. A breakout below support would signal fresh lows and confirm a top in place from the May high at 1.1011.

Trading O pportunity

My preference is to bracket the AUD/USD using a series of entry orders. I would look to sell the AUD/USD pair below support near 1.0380. Limits should be placed on a move lower at .9900 with stops at 1.0620.

Entrys to buy should be placed at 1.07705. Stops should be placed at 1.0530 or better, with limits looking for new highs near 1.1250. Risking 240 pips, to potentially make 480; gives us a 1:2 Risk/ Reward ratio on the position.

Walker England contributes to the Instructor Trading Tips articles. To receive more timely notifications on his reports, email [email protected] to be added to the distribution list.